Announcing Will Power!

Georgia Strait Alliance is pleased to announce that we have joined Will Power, a cross-country initiative designed to inspire Canadians to think differently about giving, and consider a gift to charity in their Will. Even 1% of your estate left to charity can result in a BIG gift, while still leaving 99% for loved ones.

Visit Will Power for helpful tips on turning your Will into a powerful tool to change the world.

Legacy giving for the health of our coastal waters

Learn about: Our benefactors | Why leave a legacy | How to leave a legacy | Leaving a legacy to GSA

For over 30 years, Georgia Strait Alliance has been and continues to be the most effective organization in finding solutions to what threatens the most vulnerable species in the Strait of Georgia, our spectacular inland sea. Thanks to friends like you, we tackle the most urgent issues impacting the health of our waters and the resilience of our communities, achieving our goals through education, advocacy, stewardship and collaboration.

Sadly, new threats are emerging all the time, so ensuring that GSA is here to respond to those threats for years to come is important to future generations who will call the Salish Sea home.

Choosing to remember Georgia Strait Alliance with a gift in your will is a great way to let your love for nature continue well into the future.

Your gift will make a real difference to the health of the Strait, its communities, and the thousands of species of birds, plants and animals who call it home.

Stories to Inspire

We’re happy to share with you the stories of others who left the world a better place by investing in the future of our inland sea with their legacy gift to Georgia Strait Alliance.

A creative community leader – Joscelyn Hurst, aka Joy, was a GSA donor for almost two decades, as a monthly donor and also through generous one-time gifts. As a beautiful and strong community leader, she inspired many through her teaching career, musical theatre productions and travel adventures. Joy found peace and beauty in the natural world, in particular the ocean. Her legacy gift of a life insurance policy ensured GSA’s work to protect the ocean lasts beyond her lifetime.

A creative community leader – Joscelyn Hurst, aka Joy, was a GSA donor for almost two decades, as a monthly donor and also through generous one-time gifts. As a beautiful and strong community leader, she inspired many through her teaching career, musical theatre productions and travel adventures. Joy found peace and beauty in the natural world, in particular the ocean. Her legacy gift of a life insurance policy ensured GSA’s work to protect the ocean lasts beyond her lifetime.

The would-be biologist – Joseph Jacobus Burgerjon was always amazed at how beautifully things in nature worked. This fascination led the engineer, who spent his final years on the Sunshine Coast next to the waters he loved, to form the non-profit Sargeant Bay Society. Today the Society works with BC Parks to manage the 142-hectare Sargeant Bay Provincial Park and trail system. He also gave a generous bequest to Georgia Strait Alliance, entrusting GSA to look after the ocean, which he believed sustains the planet and must be kept clean.

The would-be biologist – Joseph Jacobus Burgerjon was always amazed at how beautifully things in nature worked. This fascination led the engineer, who spent his final years on the Sunshine Coast next to the waters he loved, to form the non-profit Sargeant Bay Society. Today the Society works with BC Parks to manage the 142-hectare Sargeant Bay Provincial Park and trail system. He also gave a generous bequest to Georgia Strait Alliance, entrusting GSA to look after the ocean, which he believed sustains the planet and must be kept clean.

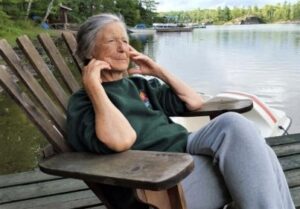

Jacqueline in her early days

From dancer to farmer – Jacqueline Cecil-Sears led a fascinating and diverse life – from dancing professionally in New York City to producing hay, wool, and strawberries on Gabriola Island, where she lived for the last three decades of her life. A true renaissance woman, Jacqueline is remembered as gentle and disciplined, with a fun, lively spirit and charismatic spark—and as an amazing dancer right up until the final months of her life. She could still put her foot over her head at 78 years old! Jacqueline passed away in 2010, and bequeathed a portion of her estate to Georgia Strait Alliance. These funds have been used to support our core work, with particular attention our campaign to oppose the increase in tanker traffic in the Strait.

Why leave a legacy?

By leaving a gift in your memory you are making a significant contribution to the future sustainability of those charitable and not for profit organizations that are most meaningful to you.

By leaving a gift in your memory you are making a significant contribution to the future sustainability of those charitable and not for profit organizations that are most meaningful to you.

It may surprise you to learn that a gift can also be a very practical addition to a financial or estate plan when tax issues are taken into consideration. Your professional advisor can teach you how giving may benefit your family and your community after you’re gone.

Personal philanthropy through a will can be an additional way to ensure that your memory lives on

How to leave a legacy

Learn about: Charitable bequests | Cash or securities | RRSPs or RRIFs | Charitable remainder of trusts | Real estate | A gift to honour someone | Insurance

There are a number of options available, each with its own tax benefits. What you choose will depend on your situation and what you’re trying to achieve. We encourage you to talk to your professional advisor (your lawyer, financial planner or accountant) as they can help you decide which option(s) will work best for you and your family. Options you may wish to consider include:

photo: Ruth Hartnup

Charitable Bequests

A charitable bequest is simply a distribution from your estate to a charitable organization through your last will and testament. There are different kinds of bequests. For each, you must use very specific language to indicate the direction of your assets. In any charitable bequest, be sure to name the recipient by their full legal name and charitable number. There are a few types of charitable bequests, including general bequests, specific bequests (of a specific item or asset), residuary bequests (percent of the residue of estate after other wishes or obligations are fulfilled), and contingency bequests (where the bequest is only made if certain conditions are met, such as another beneficiary has also passed on).

Cash or Securities

Gifts of cash are available for immediate use in the form of cash, cheque, credit card, or pre-authorized contributions paid monthly. They can also be given in the form of a general bequest in your will.

Gifting publicly-traded securities to Georgia Strait Alliance can be very advantageous from a tax perspective. The securities are typically valued at the closing price on the day of receipt by the charity – and this is the value for which the charity issues the tax receipt, regardless of the value of the shares on the day they are sold.

RRSPs or RRIFs

Gifts of retirement plans are made when you name Georgia Strait Alliance as your beneficiary. This means that upon your death the organization would receive the proceeds and your estate will receive a charitable receipt. This receipt will counterbalance your final tax return, transforming any final tax liabilities you have when you die into a charitable gift.

Charitable remainder of trusts

A gift of trust is made when you decide to make Georgia Strait Alliance the secondary beneficiary to an irrevocable trust. The primary beneficiary includes you, and if applicable, your spouse. Throughout your lifetime or for a stated period of time you will receive a predetermined amount of the trust; upon passing, GSA will receive the remainder of the trust.

Real estate

A gift of real estate is made when you leave property, buildings, land, or a place of residence that you own to the Georgia Strait Alliance. We strongly encourage you to contact GSA first before making this type of gift to ensure that it is something the organization can manage well and will benefit from. This type of gift can be given immediately or specified in your will. You will receive a charitable tax receipt for the appraised value of the property, which can be used in your final income tax return.

A gift to honour someone

We would be pleased to work with you to turn your gift into a commemoration of a loved family member, friend, animal or place that you would like to honour in perpetuity. Please contact us directly to discuss opportunities.

Insurance

As of May 2020, the BC Financial Services Authority advises that gifts of life insurance policies to BC charities are permitted, as outlined in their May 2020 Update. Check with your Financial Advisor if you have or are considering giving a gift of a life insurance policy to Georgia Strait Alliance.

To Leave a Legacy to GSA

To Leave a Legacy to GSA

Leaving a gift in your will is a simple action you can take now that can translate into lasting impact on our local waters for future generations.

To include a gift to Georgia Strait Alliance in your will, follow these three simple steps:

- Step 1: If you don’t have a will already, we recommend you seek professional help from an experienced legal and or financial advisor, to ensure your wishes are honoured. If you do have a will already, it’s fairly simple to amend it.

See resources below - Step 2: It’s important to include our full name and charitable number in your will. Without this, we may not receive your gift:

- Legal name: Georgia Strait Alliance

- Charitable registration number: 13994 2254 RR0001

- Step 3: We recommend you share the following clause with your legal advisor: “I give all or (enter a percentage or fixed amount) of the residue of my estate, a specific cash legacy, or a specific asset, to Georgia Strait Alliance charitable registration number 13994 2254 RR0001. I request that funds be used for the highest priority need as determined by the Society at the time of receipt of funds.”

More Benefactors Who Inspire Us

We’d like to introduce you to a few more people who have recently remembered GSA in their wills, and share a little bit about how their thoughtful planning is helping us preserve and protect the health of our coastal waters.

It’s hard for any of us to imagine how our own estate might benefit others—let alone our communities—long after we’re gone. Our benefactors have set a wonderful example, in thinking ahead and making an important decision about how their legacy could help the region they loved.

The activist – Peter Ajello had a lifelong commitment to humanitarian and environmental causes. His respectful listening and gentle approach to others made him an excellent model for anyone aspiring to be an effective activist. He was involved in the peace and disarmament movement, and in the early ‘80s joined Vancouver Island activists in the effort to get US nuclear submarines out of Nanoose Bay. It was through this campaign that he met GSA’s co-founder Laurie McBride and became one of our earliest members and supporters. We’re grateful for all that he contributed during his lifetime, and for his decision to help keep the environment he loved beautiful and sustainable for all to enjoy even after he was gone through his bequest to GSA.

Leaving a legacy for animal habitat – Long time Denman Island resident Margaret Sizmann was an avid traveler who like many of us, enjoyed gardening and had a deep love for animals. Margaret, who was born in Riga, Latvia, supported several charities in her lifetime and having no heirs, left her estate to six of her favourite causes, including Georgia Strait Alliance. In thinking ahead when it came time to make her will and taking action, Margaret ensured that her legacy would be the ongoing support for the animals she loved and the environment upon which they depend.

GSA was never far from his thoughts – For many consecutive years, Stuart Armour was GSA’s largest individual donor, delivering his gifts in person to our Nanaimo office. We will always fondly remember his words of encouragement as we struggled to win campaigns on issues like sewage treatment in Victoria to end netcage salmon farming in BC. To our great amazement, we learned after Stuart’s death that he has bequeathed to GSA (with the proceeds from its sale to be split equally with our partner organization, Ecojustice) a small island in Page Passage. With this generous gift, Stuart demonstrated once again how deeply committed he was to Georgia Strait Alliance and to helping us be as strong and effective as possible tackling the issues threatening the Strait now and in for many years to come.

To the friends and families of these generous people, we promise that GSA will put their bequests to the most effective use possible, so that the Georgia Strait we all love so much will remain beautiful for all to enjoy—in part, thanks to them.

We are here to help. Please call us at 250 753 3459 to find out more about creating a gift in your will and other options for legacy giving.

Disclaimer: The above information is general in nature and is not legal or tax advice.

Resources

The government of BC also has resources on wills and estate planning (or search “Wills and Estate Planning” government BC).

The People’s Law School has a guide on writing your will (or search People’s Law School writing your will).

Canadian Bar Association BC Branch has a great guide on how to plan your estate (search CBA BC Making a Will and Estate Planning).

There are also options for writing your will online, including Canadian platform Willful, which offers great tools currently available to residents of Ontario, Alberta, Saskatchewan, Nova Scotia, Manitoba, New Brunswick and B.C. If you’re interested, you can access a 15% discount on any Willful plan through this link with promo code GEORGIASTRAIT.